It’s a special treat when you walk into a bathroom and realize the floors are warm to the touch. Because it’s invisible, it’s a surprise that will delight any guest or homeowner. But for those who haven’t installed a heating system themselves, the way floor heating actually works may seem like a mystery. So how exactly does it all work?

How Does Underfloor Heating Work?

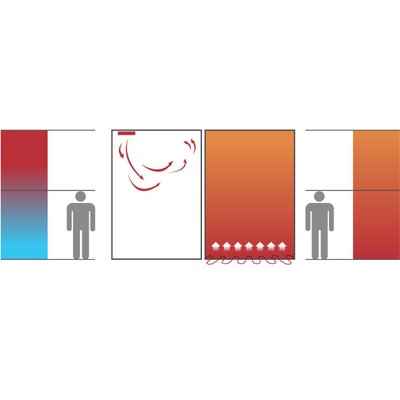

In general, radiant floor heating systems heat up a room just like the sun heats the earth. Instead of heating the air, the sun’s rays directly warm the people and objects they come into contact with. Think about it — when you’re standing in the shade, it feels noticeably colder than when you’re standing in direct sunlight. That’s because the infrared heat from the sun is in action. Similarly, radiant floor heating systems heat the flooring in a room, which then transfers to the items in the room — including your feet. This heating method takes the chill off even the coldest flooring materials and leaves any room feeling comfortably warm — even when the ambient temperature is cooler. Typically, this type of heating can be delivered two ways: via hot water (hydronic) or electricity.

Electric floor heating delivers energy efficient, consistent, comfortable warmth from the floor up.

What’s the Difference between Hot Water and Electric Floor Heating Systems?

In the simplest terms, hydronic floor heating pumps hot water through plastic tubing to warm the floor above, while electric floor heating uses electric cable to warm the floor above. However, there are many differences between the two floor heating types that homeowners should consider before making a purchase.

Hydronic Floor Heating: Pros and Cons

Hydronic floor heating systems are generally best-suited for new-construction projects and whole-house heating. They require a boiler, heat pumps, and gas lines, which should ideally be in place before considering installation of a hydronic floor heating system. When these items are already in place, the cost of operation for a whole-house system should be lower than electric floor heating because the cost per square foot drops as the square footage increases. However, if the home is not already equipped with a boiler, the overall cost may be higher because the boiler alone can cost a few thousand dollars. Additionally, hydronic systems are difficult to repair because it’s impossible to identify the exact location if a leak occurs. Plus, they take much longer to heat up than electric systems do.

Electric Floor Heating: Pros and Cons

Electric floor heating, on the other hand, is ideal for a remodeling project and better suited for partial home heating, such as in the bathrooms. Electric floor heating systems are relatively easy to install and can usually be wired seamlessly to an existing circuit. That makes including them in renovation projects especially easy. However, they may require extra amperage if they’re being installed in large rooms or throughout an entire house. This could mean you’d need to upgrade your circuit panel, which doesn’t come cheap.

On the plus side, they’re ultra-thin, which means the height of the floor would only rise minimally, and they’re inexpensive to install. At WarmlyYours, an electric floor heating system costs between $10 and $20 per square foot. Additionally, they’re easy to repair because any shorts in the system can be located with a thermographic camera. This means you won’t have to remove the entire floor to locate and repair the issue.

Finally, electric floor heating systems heat up quickly (usually within 30-60 minutes), making them more energy efficient. However, a possible downside is that the cost of operation may be high depending on the cost of electricity where you live. To find out how much it would cost to operate a system in your home, check out WarmlyYours’s Operating Cost Calculator.

Forced-air systems blow heated air into a room, leading to uneven temperatures, while radiant floor heating systems heat from the floor up, providing even heat.

How Does In-Floor Heating Compare to Central Air Heating? Is Underfloor Heating Better than Central Heating?

Central air heating, also known as forced-air heating, uses a furnace to heat the air and distribute it via ductwork throughout the home. This is one of the most common forms of whole-house heating in America, but it’s also one of the least energy efficient and least cost effective. Ductwork is subject to small openings, which means it’s prone to air leakage. Ductwork also typically travels through cold spaces, like the attic or basement, which leads to heat being lost along the way. Plus, because heat vents are only located in certain areas of the home, you’re left with uneven heat. The way the heat is distributed also leads to the distribution of dust and other allergens throughout the home, which can be problematic for allergy sufferers.

In-floor heating inherently eliminates all of these issues. It’s nearly 100 percent energy efficient because the heat travels directly from the heating element to the floor and room above. It blankets a room in even warmth because it is installed under the flooring throughout the room, instead of in only one area. And, it does not disturb allergens in the home because it’s not blowing air around.

Do I have to Replace my Floor to Install Radiant Floor Heating?

Yes. Radiant floor heating systems are installed underneath the new flooring, which means you’ll have to remove your existing floor in order to install a new system. That’s why the best time to install a radiant floor heating system is when you’re already considering remodeling a room or at least updating your flooring.

Does Floor Heating Work with Every Floor Type?

In the United States, yes, radiant heating will work with any flooring replacement. WarmlyYours Radiant Heating offers floor-heating systems for use under tile (tile floors are the most commonly heated floor covering), stone, vinyl flooring, hardwood, carpet, laminate, and even under a floating wood floor. It can even be embedded in concrete. The only exception is that electric floor heating has not been approved for use under carpet in Canada. Please note that the radiant heating systems used for floating floors will differ from those are designed to be embedded.

For more information about the specific brands available for each flooring choice, click here.

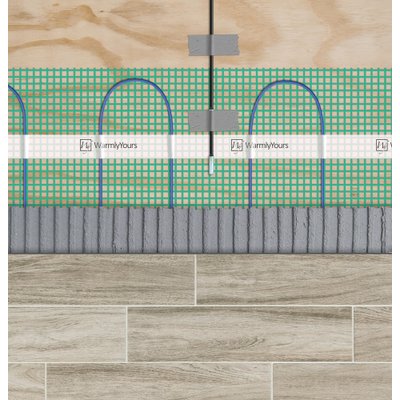

TempZone floor-heating systems are embedded in thinset underneath tile, stone or nailed hardwood floors.

Embedded vs. Adhesive/Thinset-free Floor Heating Systems

At WarmlyYours, there are three different types of in-floor heating systems: TempZone™, Environ™ and Slab Heating. TempZone™ and Slab Heating systems must be embedded, while Environ™ systems do not. More specifically, TempZone™ systems are embedded in thinset or self-leveling cement under tile, stone and nailed hardwood; and Slab Heating systems are embedded in freshly poured cement, such as in a basement, garage or sunroom.

Environ™ systems, on the other hand, were made to heat carpet, laminate and floating hardwood. These flooring types do not require adhesive for installation and, therefore, neither does the floor-heating system. The heating cable is sandwiched between two layers of aluminum foil laminate, which facilitates gentle heat for these more sensitive flooring materials. Installation is particularly easy for this system because it can be simply rolled out on top of the subfloor or carpet pad and hooked up to the thermostat.

Can I Cut the Floor Heating Element to Make it Fit My Project?

The simple answer to this question is no, you can't cut the floor heating element in order to make it fit your project. There's a very good reason for this: Ohm's Law. Here's a great WarmlyYours post about this topic with more information but essentially it boils down to this: when you shorten a floor heating element yourself, you're lowering the level of electrical resistance the heating element can provide which can cause the heating element to overheat and possibly fail.

While you can't cut the heating part of a floor heating element, you generally can cut the cold lead which is spliced to the heating part of the cable. Sometimes this is necessary to save space in a gangbox but you'll definitely want to consult your install manual to confirm before attempting to shorten the cold lead.

Is Electric In-Floor Heating Safe?

Yes. WarmlyYours floor-heating systems are UL listed and have withstood rigorous safety tests in the United States and Canada.

What about Electromagnetic Fields (EMFs)?

First off, it’s important to realize that EMFs exist at safe levels in everyday electrical appliances. For example, a vacuum emits EMFs of 300 Milligauss (mG); a microwave emits 200 mG; and a dishwasher emits 20 mG. By comparison, WarmlyYours’s TempZone™ system emits only 1.8 mG, so it’s an ultra-low EMF level. When you think about EMFs produced by high-voltage power lines, that level can be harmful, but the EMF levels in floor-heating systems offer no cause for concern.

Can Electric Floor Heating be a Primary Heat Source?

In most cases, yes. However, if a room is outfitted with a drafty fireplace or outdated windows, it may be prone to air leakage. In this case, in-floor heating would not be an ideal candidate for primary heating; however, it would be a great supplemental heat source. To find out whether radiant floor heating will work better as a primary or supplementary heat source in the room you want to heat, check out WarmlyYours’s Heat Loss Calculator.

Use the WarmlyYours Heat Loss Calculator to Find out

WarmlyYours created a Heat Loss Calculator to help factor in every aspect of your room to determine if it’s a good candidate for primary floor heating. By answering a few questions about the room you plan to heat, you can find out for sure whether radiant floor heating should be a primary or supplementary heating source. The calculator will also give you information about the cost of operating the system, such as how much it would cost to run during the coldest month of the year.

How Much Does a Floor Warming System Cost to Run? Does Electric Floor Heat Cost a lot per Month?

It depends on the electricity rate in your area. According to the U.S. Energy Information Administration, the average residential price of electricity in the United States is 13 cents per kilowatt hour. Your city’s specific rate as well as how much you plan to run your system will determine how expensive it is to operate. Keep in mind that programmable thermostats can be used to

Electric Floor Heating Operating Cost Calculator

WarmlyYours created an Operating Cost Calculator to make it especially easy for homeowners to calculate their system’s cost of operation. By selecting their type of heating system, the size of the room, their zip code, and how many hours a day they intend to run the system, the calculator will determine the daily, monthly and annual cost of operation. Use the calculator for yourself below.

How Much Does a Floor Heating System Cost?

It depends on the type of system you buy and how many square feet you plan to heat. Generally, WarmlyYours floor-heating systems cost between $8 and $20 per square foot. The less labor-intensive options may cost a little more because of added material that makes them easier to install. For instance, it will be less expensive to heat with loose cable that must be woven back and forth across a room than with an installation membrane designed to boost speed of installation and protect the flooring above. Furthermore, the more square footage you heat, the lower the price of the floor-heating system.

TempZone Cable with a Prodeso Installation Membrane costs more than the loose cable alone because of its added installation benefits.

Use the WarmlyYours Radiant Heat Cost Calculator to Find out

WarmlyYours created a Radiant Heat Cost Calculator to help homeowners select the right product at the right price point for their home. By answering a few questions about their project, such as the flooring type and square footage, WarmlyYours will provide an instant quote with all applicable products. The quote will provide the cost of each system as well as the differences between the options, so the homeowner will have the best idea of what system will meet their needs.

When beginning your in-floor heating project, the best place to start is with the Radiant Heat Cost Calculator. Once you’ve selected the system you want, WarmlyYours will follow up with a Custom Installation Plan, which will show exactly how the system should be installed, where the thermostat should be located, how much power it will draw, and more.

Once you have your materials in hand and you’re ready to start your project — whether you’re installing it yourself or having an electrician do it — don’t forget that WarmlyYours’s technical support team is available by phone 24/7. Feel free to give one of our experts a call at 800-875-5285 with any questions.

If I have hot water in floor heating and a wool rug with rubber underlay..would that cause any problems

That could cause a problem with "trapped heat" due to the insulative properties of both wool and rubber. It will depend on a number of factors (size and thickness of the rug, the r-level of the rug, the size of your heating system) but there is a good chance that this could negatively impact the performance of your heating system, unfortunately.